Helpful Summary

Overview: We explored the integration of AI chatbots in banking, highlighting their revolutionizing impact on customer service. These virtual assistants offer 24/7 availability, instant responses, cost efficiency, personalized recommendations, enhanced user experience, risk mitigation, and scalability.

Why listen to us: We’ve helped over 2,000 businesses start using chatbots as a tool for improved customer support and automated customer interactions.

Why this is important: Chatbots in banking significantly enhance customer support, offering a seamless, efficient, and intuitive banking experience, thus improving overall satisfaction and operational efficiency.

Action points: We recommend considering factors like seamless banking system integration, robust security, customization, multi-channel support, analytics, and compliance with regulatory standards when choosing a chatbot for banking.

Further research: To delve deeper, explore our top picks for banking chatbots, including Chatling, Tidio, TARS, Zendesk, and Ada, to understand their unique features and how they can address specific banking needs.

Chatbots for banking represent a pivotal integration of artificial intelligence (AI) into the financial sector, revolutionizing the way customers interact with their banks. These chatbots are sophisticated virtual assistants capable of understanding and responding to natural language queries from users.

They are deployed across various digital channels, including websites, mobile apps, and messaging platforms, offering a seamless and intuitive interface for banking services.

In this Chatling article, we’ll explore our list of the best AI chatbot options for banking. Let’s get started!

- Why Listen To Us?

- What are Chatbots for Banking?

- Benefits of Chatbots in Banking

- Criteria To Consider When Choosing A Chatbot for Banking

- Integration with Banking Systems

- Security Features

- Customization Options

- Multi-Channel Support

- Analytics and Reporting

- Compliance with Regulatory Standards

- 5 Best AI Chatbots for Banking

- Conclusion

Why Listen To Us?

At Chatling, our credibility is backed by the satisfaction of thousands of businesses that have experienced firsthand the transformative impact of our AI-powered chatbots.

With numerous positive reviews highlighting our solutions' time-saving efficiency and effectiveness, you can trust Chatling to deliver results that enhance customer engagement, streamline operations, and drive business success.

What are Chatbots for Banking?

Chatbots for banking are AI-powered virtual assistants designed to interact with clients through natural language processing (NLP) to assist, answer queries, and perform various banking tasks. Thanks to NLP, they can do more than just understand customer queries. They can interpret the nuance of human language to help when customers want to know their account balance, transaction history or need some financial advice.

These chatbots are integrated into banking platforms such as websites, mobile apps, or messaging platforms, offering customers a convenient and efficient way to engage with their financial institutions.

With the help of AI-powered chatbots, human banking agents have more time and space to accommodate clients who have complex cases they need resolved.

Benefits of Chatbots in Banking

- 24/7 Availability: Chatbots enable round-the-clock customer service, allowing users to access assistance and information at any time, regardless of traditional banking hours.

- Instant Responses: Chatbots provide instant responses to customer inquiries, reducing wait times and improving overall customer satisfaction.

- Cost Efficiency: Implementing chatbots can lead to cost savings for banks by reducing the need for human customer support agents to handle routine inquiries.

- Personalized Recommendations: Through data analysis and machine learning algorithms, chatbots can offer personalized financial advice and product recommendations tailored to individual customer needs and preferences.

- Enhanced User Experience: Chatbots offer a user-friendly interface for interacting with banking services, simplifying processes such as account management, fund transfers, and bill payments.

- Risk Mitigation: Chatbots can assist in fraud detection and prevention by monitoring transactions in real-time and flagging suspicious activities.

- Scalability: Chatbots can handle multiple customer inquiries simultaneously, allowing banks to scale their customer service operations without significantly increasing overhead costs.

Criteria To Consider When Choosing A Chatbot for Banking

Firstly, a robust chatbot for banking should possess advanced NLP capabilities to accurately understand and respond to user queries, regardless of language nuances or variations.

So, before selecting your AI chatbot for banking, consider these other factors.

Integration with Banking Systems

Seamless integration with the bank's existing systems and databases is crucial. The chatbot should securely access customer information and perform transactions without compromising data integrity or security.

Security Features

Robust security measures, such as encryption and authentication protocols, should be implemented to safeguard sensitive customer data and transactions. The chatbot should also comply with industry standards and regulations to prevent unauthorized access.

Customization Options

The chatbot should allow customization to reflect your bank's branding and provide tailored responses based on your customer's banking history and preferences. This flexibility enhances brand consistency and improves the overall user experience.

Multi-Channel Support

The chatbot should be accessible across multiple digital channels, including websites, mobile apps, and messaging platforms. This ensures that customers can interact with the chatbot through their preferred channels, enhancing accessibility and convenience.

Analytics and Reporting

Analytics and reporting capabilities enable banks to track user interactions, identify trends, and measure the chatbot's performance. Insights derived from these analytics can inform strategic decisions and improve the chatbot's effectiveness over time.

Compliance with Regulatory Standards

Compliance with regulatory standards, such as GDPR (General Data Protection Regulation) and PCI DSS (Payment Card Industry Data Security Standard), is paramount. The chatbot must adhere to data privacy and security regulations to protect customer information and maintain regulatory compliance.

5 Best AI Chatbots for Banking

Check out our top 5 picks for the best AI chatbots for banking:

- Chatling

- Tidio

- Ada CX

- TARS

- Zendesk

1. Chatling

Chatling is an innovative AI chatbot solution designed to empower businesses by simplifying the creation of custom conversational chatbots within minutes.

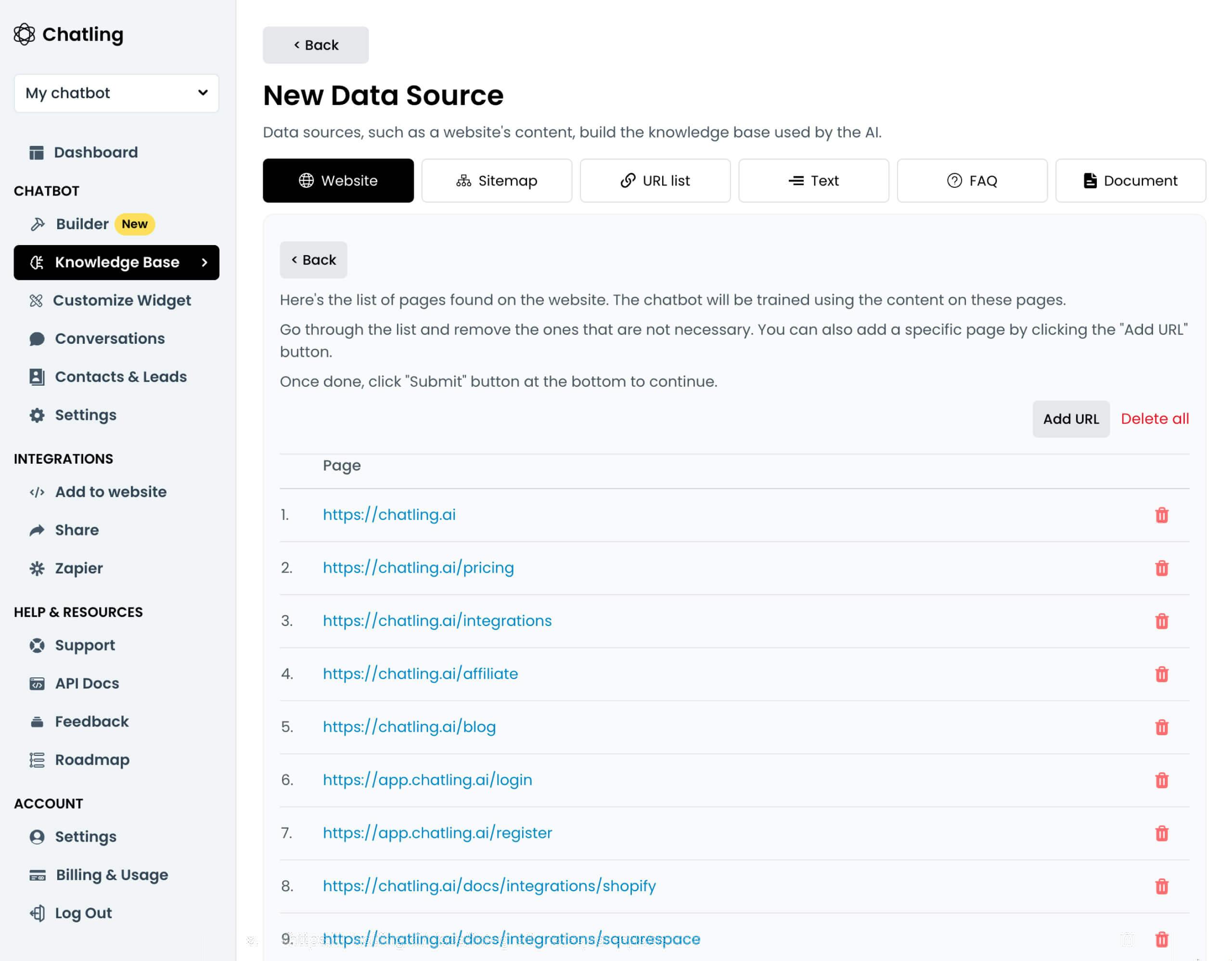

The process is simple–you connect data sources like websites and policy documents, and your Chatling chatbot is ready to go. You can also tailor your chatbot to different use cases by adding or removing data from its training data set.

With Chatling, banks can deliver round-the-clock customer service and support, streamline their sales processes, and alleviate the workload of human resources staff.

Key Features

- Integrate Multiple Data Sources: With Chatling, input various data sources for the chatbot to train on different aspects of your bank operations. This ensures that it delivers accurate responses by learning directly from your business's resources.

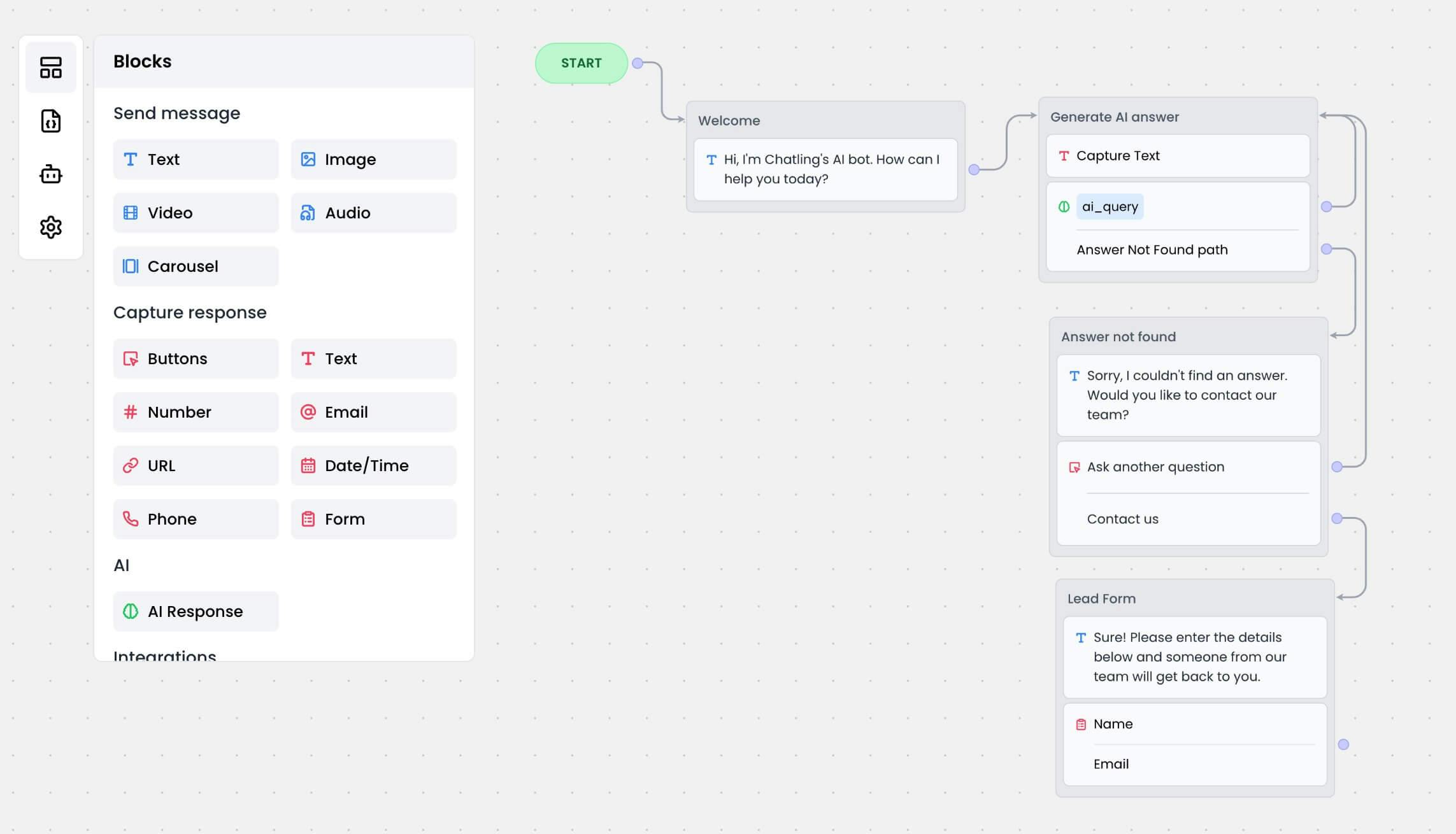

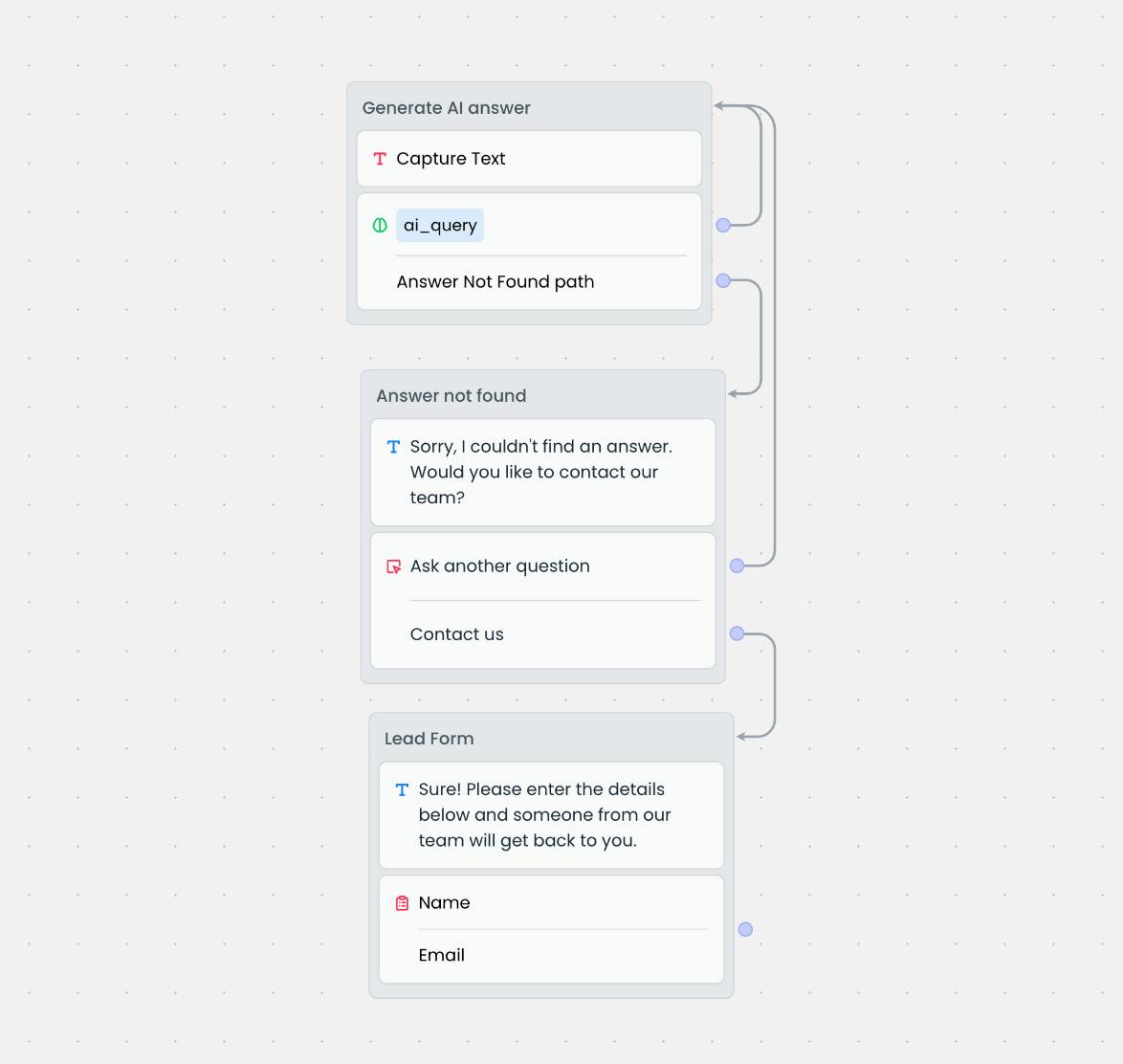

- Visual Builder: To give you more control over your chatbot’s flow, you can design it using our drag-and-drop builder. It’s great for building complex chatbots that you can adjust whenever your needs change.

- Define Chatbot’s Path: We offer the capability to define your chatbot’s path when the AI cannot answer a customer query. This helps you efficiently redirect customers to fill in their contact information, for example, so that your team can attend to them immediately.

- Customize Options: Customize the chatbot's appearance to match your brand's identity, from changing the icon and colors, to adjusting the textbox size, ensuring seamless integration with your website's design.

- Embed the Chatbot: Easily integrate the AI chatbot on any number of websites instantly by copying and pasting the provided widget code into your site's header, requiring no coding skills.

- Analyze Conversations: Gain insights from conversations to better understand customer queries. This allows you to adjust the bot’s responses for enhanced accuracy and efficiency.

- Provide Multilingual Support: Enable the chatbot to support multiple languages, ensuring accessibility to a global audience, and scalability to grow with your business without requiring additional support agents.

- API: Integrate the chatbot seamlessly into your current systems and workflows with our user-friendly API.

Pros & Cons

Pros

- Free plan available

- Very easy to train

- Customizable

- No-coding chatbot creation

- Reliable responses

- Multilingual support

- Comprehensive analytics

Cons

- Limited advanced features in the free version

2. Tidio

Tidio is a comprehensive customer service platform tailored for organizations seeking to enhance customer support and boost sales through AI-powered chatbots. These chatbots engage customers in real-time, providing instant, personalized service that can significantly improve satisfaction levels.

Key Features

- Automate Customer Interactions: Tidio offers AI-powered chatbots capable of automating customer interactions, resolving queries in real time, and delivering personalized customer experiences.

- Tailor Chatbot Experience: Utilize over 35 pre-designed chatbot templates and customize UI elements to match your brand and meet specific customer needs, whether on e-commerce sites or social media channels.

- Build Custom Chatbot Workflows: Utilize Tidio's drag-and-drop visual chatbot builder to create custom chatbot workflows effortlessly, without the need for coding knowledge, simplifying the chatbot development process for businesses of all technical backgrounds.

Pros & Cons

Pros

- Easy to use

- Affordable pricing plans

- Customizable chatbots

- Integration capabilities

- Omnichannel support

Cons

- Limited social media integration

- Some users have reported issues with Tidio's notifications, such as delays in alerting users about new conversations

3. Ada CX

Ada CX is an AI-powered customer service automation platform designed to act as a complete customer experience team in one platform. It transforms customer service agents into AI coaches, enabling businesses to automate up to 75% of customer inquiries across web, SMS, and social channels efficiently.

Key Features

- Personalized Customer Experiences: Uses AI to provide tailored responses based on individual customer preferences and history.

- Multilingual Support: Supports multiple languages, allowing businesses to communicate with customers globally in their preferred language.

- Seamless Integration: Integrates with existing business systems and workflows to provide a unified customer service experience.

Pros & Cons

Pros

- High automation potential

- Personalization

- Multichannel

- Easy integration

- Multilingual support

Cons

- Potential learning curve for beginners

4. TARS

TARS welcomes online banking users with assistance offers, enhancing the customer experience with a blend of interpersonal interaction and automated support for basic inquiries. TARS stands out for its extensive range of chatbot templates, specifically designed for the banking industry, simplifying setup and offering features like geolocation data collection.

Key Features

- Simplifies the Creation and Deployment of Chatbots: TARS enables businesses to easily design, build, and launch chatbots without needing any coding knowledge.

- Offers Extensive Customization with Templates: Provides hundreds of industry-specific templates, allowing for rapid deployment of chatbots tailored to specific business needs and customer queries, ensuring relevance and efficiency in interactions.

- Facilitates Multichannel Engagement: TARS chatbots can be deployed across various digital channels, including websites, WhatsApp, Facebook Messenger, and email, creating a seamless omnichannel experience for customers seeking support or information.

Pros & Cons

Pros

- Simple chatbot creation

- No coding is needed for setup and configuration

- Extensive template library for various use cases

- Integrates with Zapier for wider software connectivity

- Provides analytics for chatbot performance monitoring

Cons

- Lacks capability for broadcasts or sequences

- No support for AI & NLP features like keyword recognition

5. Zendesk

Zendesk for banks enhances client relationships by centralizing customer data, enabling personalized support with top-notch security standards. It supports seamless 24/7 access to accounts, leveraging automation, AI, and self-service for efficient financial advice.

With Zendesk, banks can offer a support experience that anticipates and swiftly resolves client issues, fostering stronger trust and satisfaction.

Key Features

- Automates responses: Zendesk's AI can automatically handle common customer questions, reducing the need for live agent intervention.

- Integrates with multiple channels: Allows businesses to manage customer interactions across email, chat, social media, and more from a single interface.

- Provides analytics and reporting: Offers in-depth insights into customer service performance, helping businesses improve their support strategies.

Pros & Cons

Pros

- Offers a wide range of tools

- Highly customizable

- Detailed reports and analytics

- Scalability

- Omnichannel support

Cons

- Learning curve

- May be expensive for small businesses or startups

Conclusion

Chatbots have emerged as a transformative technology in the banking industry, offering numerous benefits for both financial institutions and customers alike. By providing round-the-clock assistance, instant responses, and personalized recommendations, chatbots enhance convenience, streamline processes, and improve overall user experience.

However, choosing the right chatbot for banking requires careful consideration of various factors, including natural language processing capabilities, integration with banking systems, security features, customization options, multi-channel support, analytics, compliance with regulatory standards, and scalability.

Chatling is a user-friendly tool for banks that allows you to create personalized AI chatbots without coding effortlessly. Our platform’s versatility allows for easy customization, making it adaptable to specific branding requirements and ensuring a consistent customer experience.

Get started for free today!