Quick Summary

- Overview: This article introduces you to four chatbots that work well for businesses in the financial services industry.

- Why Trust Us: We’ve helped 2,000+ businesses build chatbots that streamline sales, marketing, and customer support—we know what to look for in a great chatbot.

- Why It Matters: Customer interaction is extremely important in the financial services industry, where complex processes and high-stakes decisions can be intimidating for clients. Chatbots offer a solution by providing personalized, efficient, and engaging experiences.

- Action Points: Our top picks are Chatling, Tidio, TARS, and Zendesk.

- Further Research: Check out our guides to the best small business chatbots, e-commerce chatbots, and free chatbots.

Customer interaction is essential in every industry—especially in the financial services industry. With complex processes and high-stakes decisions, customers and clients can often feel overwhelmed or intimidated.

That's why chatbots are becoming increasingly popular in this sector. They offer 24/7 support and instant, accurate responses to customer inquiries. But with so many chatbot options on the market, it can be overwhelming for businesses to choose the right one.

In this Chatling article, we dive into the features and pricing of four top chatbot providers in the financial services industry.

What Are Chatbots in Financial Services?

Chatbots in financial services are computer programs that use artificial intelligence (AI) to simulate conversations with human users. They can be integrated into messaging platforms, websites, or mobile apps for customer support and assistance.

In the financial services industry, chatbots can help customers with specific tasks like:

- Account inquiries

- Balance checks

- Transaction history

- Transfer requests

But, more common use cases involve using chatbots to automate routine customer support tasks like answering FAQs and guiding customers to the resources and information they need.

Why Listen to Us?

At Chatling, we’ve worked with thousands of businesses to automate conversations across customer service, sales, and marketing. Our AI chatbots improve resolution rates by an average of 53% and reduce resolution time by an average of 250%—all while enhancing the customer experience.

The bottom line—we know chatbots and we know how to make them work for you.

Benefits of Chatbots in Financial Services

Here are some of the benefits chatbots bring to financial services:

- Enhanced Customer Engagement: Chatbots in financial services provide instant and personalized interactions, engaging customers in real-time.

- Operational Efficiency: By handling repetitive tasks, financial institutions can optimize workflows, reduce manual workload, and allocate resources more effectively.

- 24/7 Accessibility: Chatbots offer round-the-clock accessibility, allowing users to access financial information, support, and services at any time, which ensures continuous availability and accommodates diverse time zones.

- Risk Mitigation and Security: Chatbots in financial services contribute to enhanced security by providing real-time fraud detection and alert systems.

4 Best Chatbots in Financial Services

- Chatling

- Tidio

- TARS

- Zendesk

1. Chatling

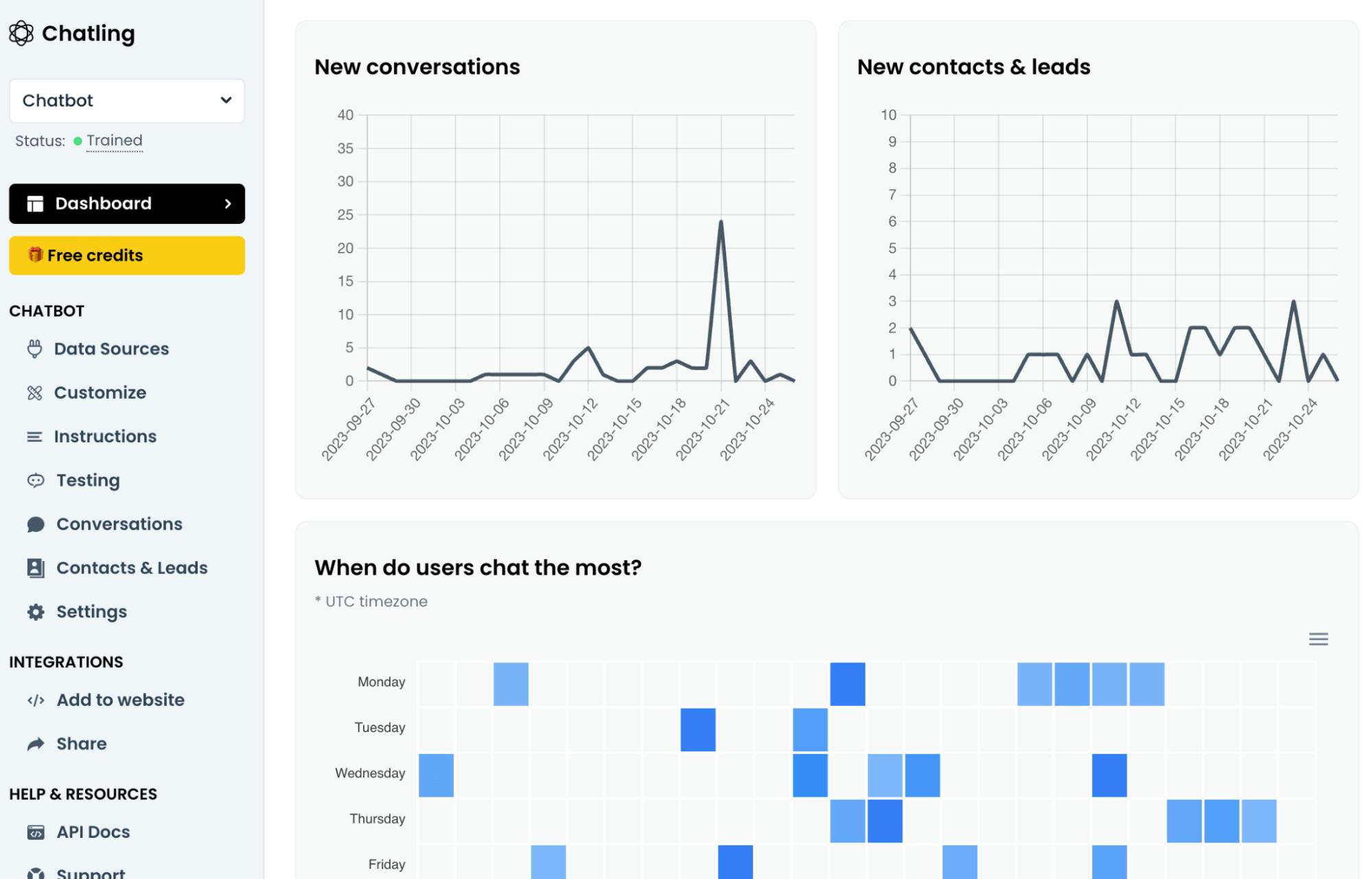

Chatling is an AI chatbot solution that makes it easy for anyone to build a custom, conversational chatbot in minutes. Just link your data sources, embed the chatbot on any website or app, and start engaging with your customers in a personalized and efficient way.

Chatling offers a range of important features for financial services, including multilingual support, lead generation and capture, detailed conversation analytics, and accurate responses. With Chatling, financial institutions can provide round-the-clock customer service and support, streamline their sales process, and reduce workloads of human resources staff.

Key Features

- Capture Leads: Provide potential leads with comprehensive information for informed decision-making and guide them to the subsequent stage of your sales funnel.

- Full Customization: Customize the chatbot's appearance, personality, and conduct to align with your brand identity.

- Train on your Data: Connect websites, FAQs, knowledge bases, and documents, or include text inputs to train your chatbot automatically.

- Easy Integration: Effortlessly integrate with any website, including WordPress, Squarespace, PrestaShop, and Shopify.

- Analytics: Monitor customer inquiries to your chatbot and trace customer journeys for enhanced insights.

Pros & Cons

Pros

- Great free plan

- Automatic chatbot training

- Supports multilingual conversations

- 24/7 availability

- Full chatbot customization

- GPT-4 access

- No-code chatbots

Cons

- No live chat available yet

2. Tidio

Tidio is a customer service platform that offers financial services businesses intuitive tools for building AI and rule-based chatbots.

Key Features

- Lead Generation Templates: Select from over 35 chatbot templates to drive lead generation and convert prospects into customers.

- Lyro AI: Arm chatbots with NLP-powered AI to understand customers and offer personalized support.

- Smart Routing: Transfer discussions to the right agent at the right moment.

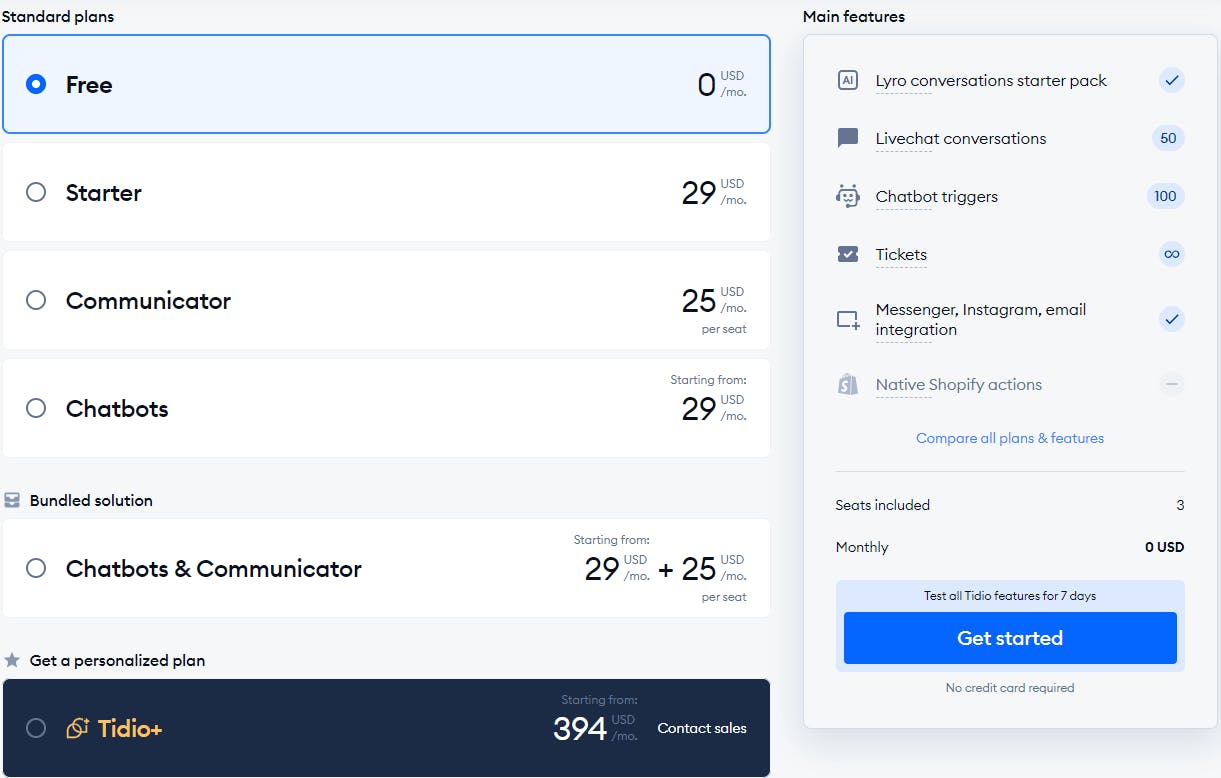

Pricing

Tidio offers three plans for its chatbots—Free, Automation ($24.17/month), and Tidio+ ($398+/month).

Lyro AI is an add-on that costs $39 per 50 conversations.

Pros & Cons

Pros

- Free plan

- Great chatbot templates

- All-in-one customer support tool

Cons

- E-commerce focus with templates

- Bot builder can be buggy

3. TARS

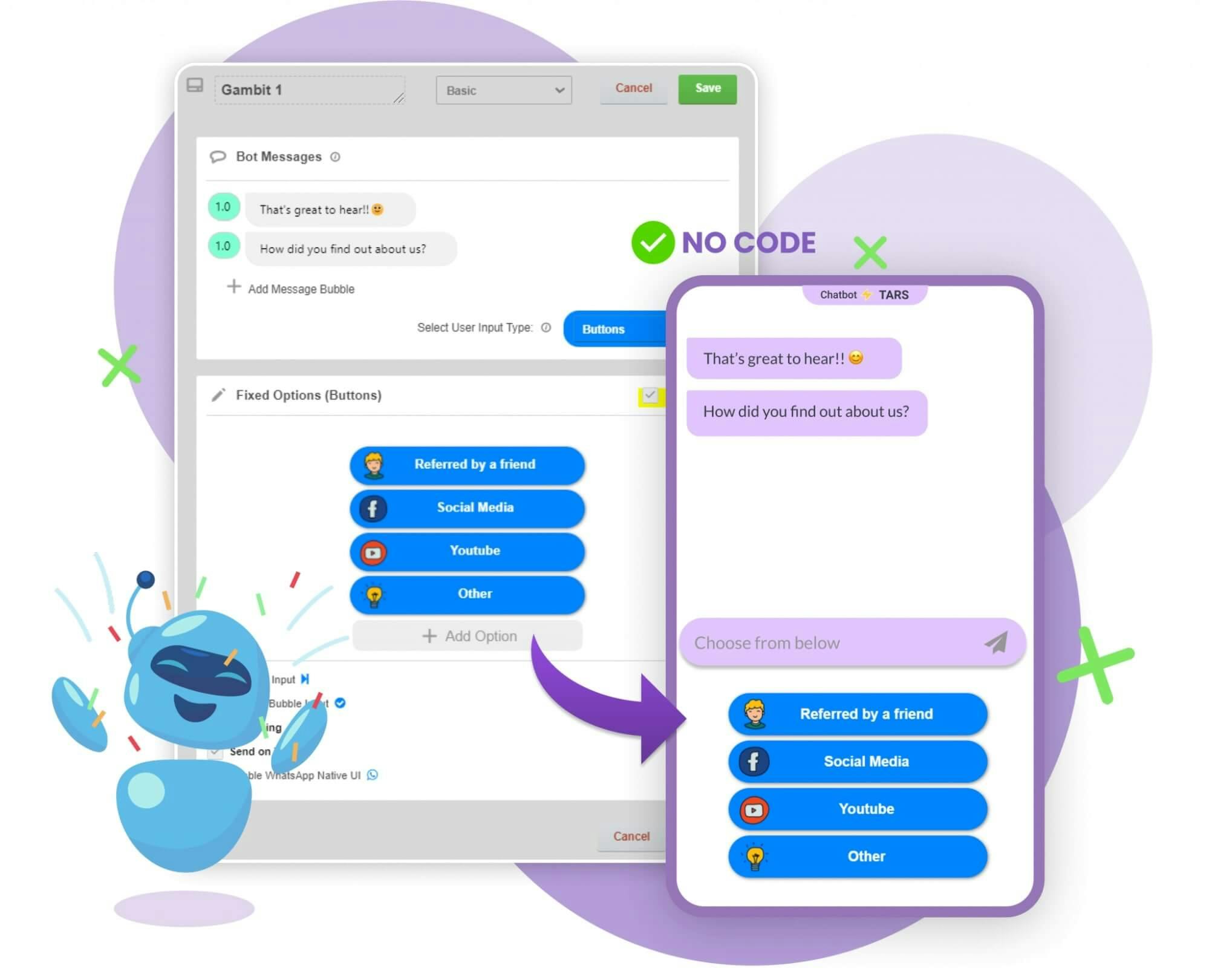

TARS is a chatbot automation platform that offers enterprise-grade data security and 24/7 technical support.

With a selection of 1,000+ pre-made templates and a user-friendly drag-and-drop builder, it’s easy to build and customize a bot for your unique needs.

Key Features

- No-code Chatbot Builder: Choose and customize templates effortlessly with TARS’s no-code builder.

- Integrate Chatbots: Integrate chatbots into your website, social media profiles, or messaging platforms like WhatsApp and Facebook Messenger.

- Multilingual Support: TARS allows you to offer multilingual support by building chatbots in multiple languages.

Pricing

Contact sales for a quote.

Pros & Cons

Pros

- Automation consultation available

- High degree of flexibility

- Great integrations

Cons

- No publicly available pricing

4. Zendesk

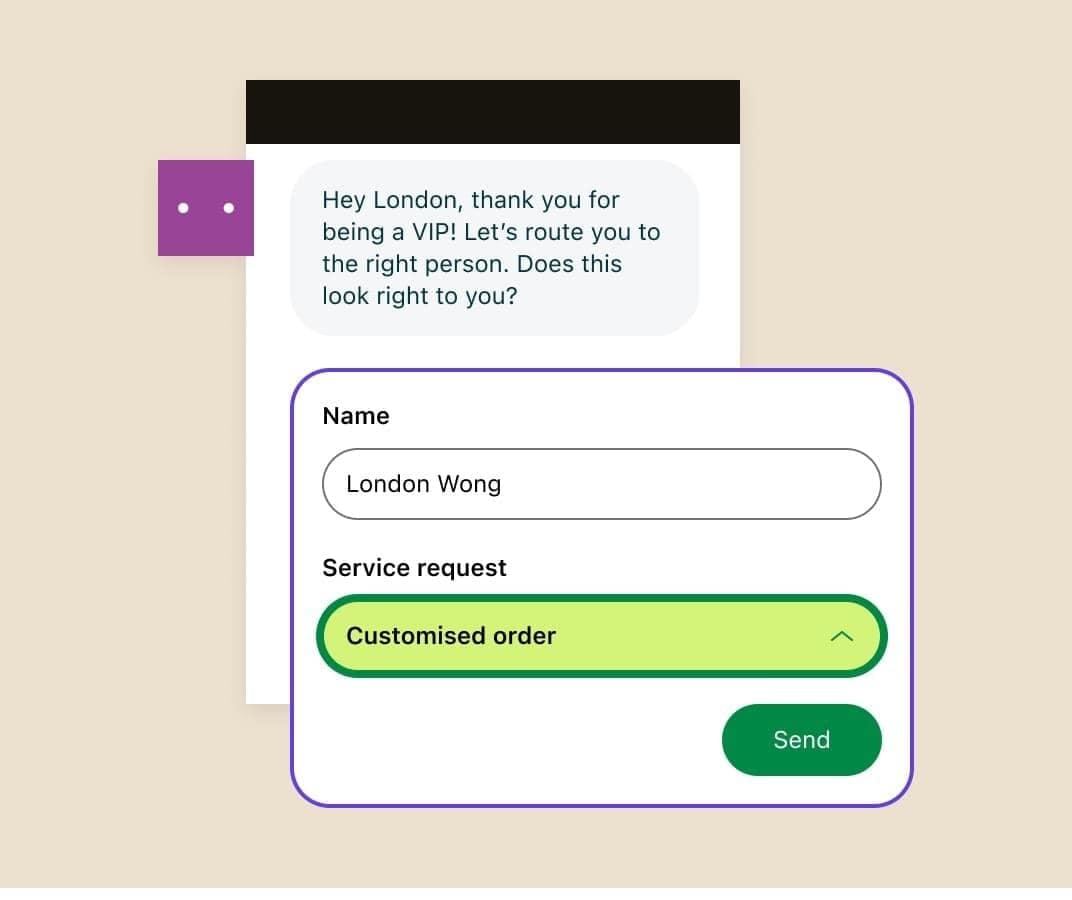

Zendesk is a well-known omnichannel support platform and sales CRM that offers a wide range of solutions. One of their key features is the ability to build and manage chatbots through their platform.

Key Features

- Detect Customer Intent: Analyzes customer messages and insights to help agents understand their intentions and needs.

- Gather Customer Details: Collects and compiles relevant information like names, emails, and issues about the customer for better assistance.

- Bot Personas: Create personas for your chatbots and easily toggle between them based on context.

Pricing

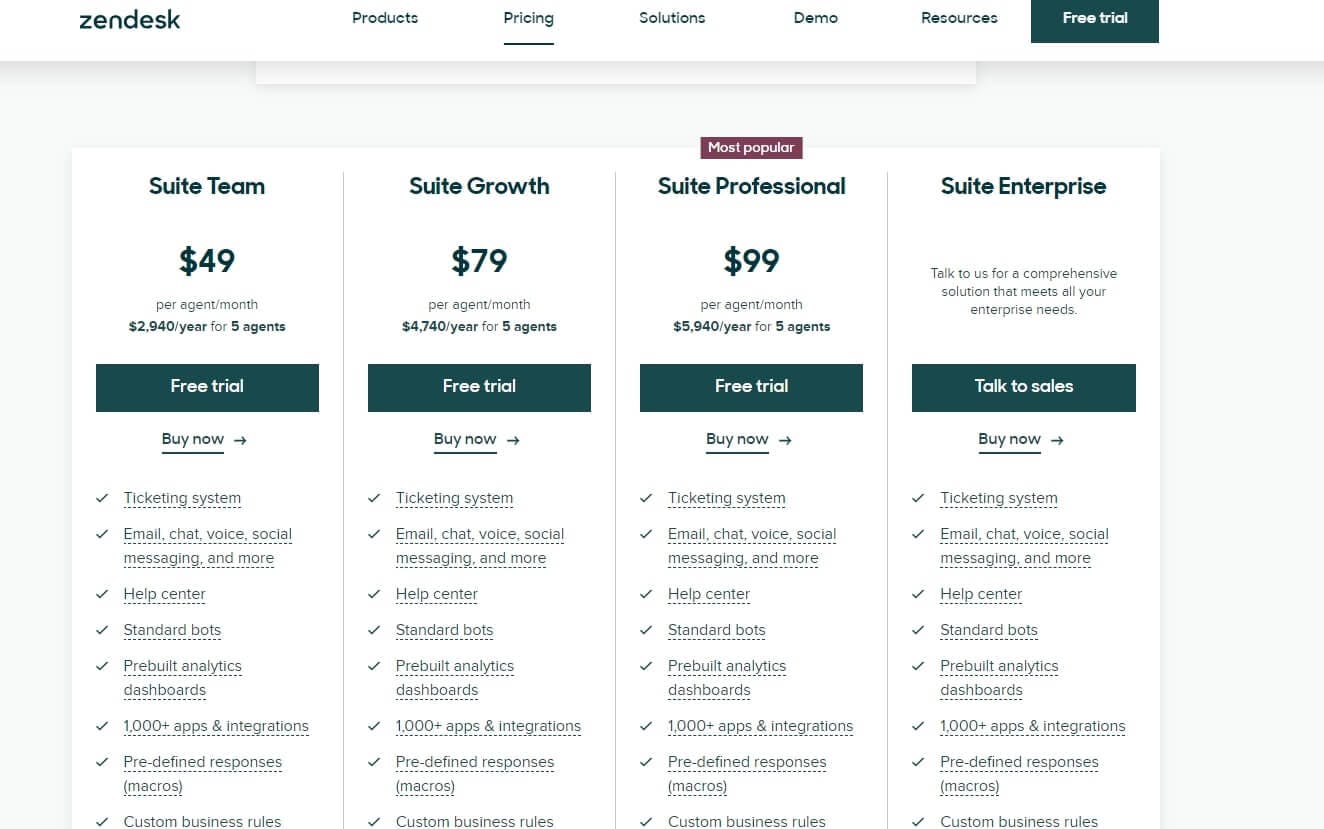

All five plans for Zendesk Service—Suite Team ($55/user/month), Suite Growth ($89/user/month), Suite Professional ($115/user/month), and Suite Enterprise (custom)—support chatbots.

Pros & Cons

Pros

- Powerful customer support platform

- Great data security features

- Highly customizable bots

Cons

- Can be very expensive

Conclusion

From 24/7 support to personalized lead generation, chatbots have demonstrated their ability to elevate user experiences while optimizing operational workflows. The options in this list are a great starting point for businesses looking to implement chatbots.

At Chatling, we help businesses in the financial services industry enhance their customer support and operational efficiency through our powerful chatbot solutions. Add Chatling’s chatbots to any website for instant customer engagement.

Get started for free today.